Innovation Case Study 1: Transforming the World’s Biggest Coal Port

- Dr John H Howard

- Jan 28, 2025

- 3 min read

Updated: May 25, 2025

Roy Green* 25 Jan, 2025

The Port of Newcastle's evolution from a traditional coal export hub to a diversified maritime gateway exemplifies how legacy infrastructure can adapt to emerging economic and environmental imperatives. This transformation, occurring against a backdrop of global decarbonisation efforts and shifting trade dynamics, offers valuable insights into large-scale industrial adaptation.

When I assumed the chair position in December 2017, the world’s biggest coal port faced a critical strategic inflection point. The facility's overwhelming dependence on coal exports, representing 85 per cent of revenue, created significant vulnerability as global markets began showing structural shifts away from fossil fuels. This realisation catalysed an ambitious diversification strategy that would fundamentally reshape the port's operational model.

Three distinct but interconnected challenges emerged. First, flattening global coal markets threatened to strand valuable assets. Second, controversial privatisation decisions in 2013-14 led to regulatory constraints, particularly regarding container terminal development. Third, accelerating climate action policies worldwide necessitated rapid adaptation to new energy paradigms.

The port's response demonstrates how industrial assets can pivot towards emerging opportunities. A new entrepreneurial management team redesigned the port’s strategy and vision in consultation with the workforce as part of a structured process of business model innovation. This followed management theorist Peter Drucker’s observation that, “Innovation is the specific instrument of entrepreneurship... the act that endows resources with a new capacity to create wealth”.

There was an urgent need at the outset for the port to adjust the access charge for coal producers, which, remarkably, had not been increased in the previous 19 years of public ownership. In effect, New South Wales taxpayers were cross-subsidising coal exports. After a lengthy court battle, this was achieved, providing security for future initiatives.

Simultaneously, the port’s successful campaign to remove an anti-competitive container terminal restriction imposed at the time of privatisation opened new pathways for significant capacity expansion. This development will address critical inefficiencies in Australia's east coast container handling operations, where existing ports rank in the bottom 20 per cent globally for productivity.

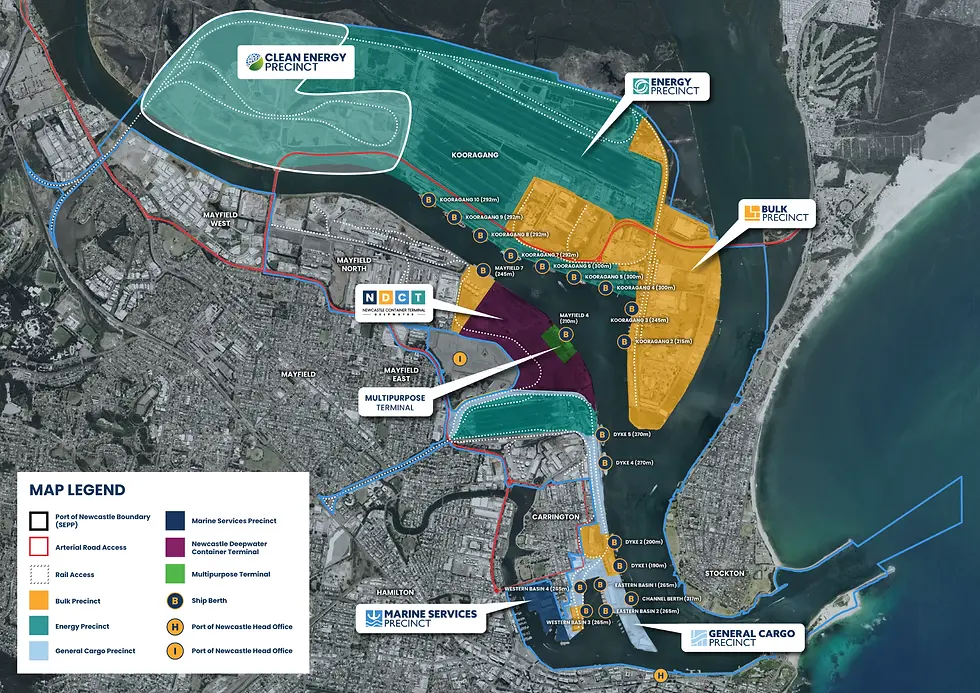

Strategic planning has also positioned Newcastle as an emerging clean energy hub, supported by federal government investment. The development of hydrogen infrastructure presents dual opportunities: serving domestic industrial requirements while establishing export prospects focused on North Asian and European markets. This initiative aligns with research indicating growing demand for green hydrogen among key trading partners.

Historically, the port’s prosperity has been intertwined with that of the Hunter region, and now its transformation will promote regional industrial renewal. The potential for green iron and steel production, utilising zero-carbon technologies, exemplifies how traditional capabilities can be reimagined for a low-carbon economy. This is an opportunity to take advantage of global trends in sustainable manufacturing and circular economy principles.

However, the port’s privatised ownership structure presents unique challenges for implementing transformative projects. While private ownership can drive innovation and challenge operational assumptions, it also introduces complex stakeholder dynamics. Current understanding suggests successful transformation will require careful balancing of shareholder returns with broader community benefits.

Several additional promising developments are already underway. The port's emergence as a preferred RO-RO destination for vehicle imports demonstrates effective market diversification. Additionally, the handling of wind turbine components, coupled with potential domestic manufacturing under the Future Made in Australia program, builds capacity in renewable energy infrastructure.

The ongoing transformation of the Port of Newcastle illuminates several key insights for infrastructure adaptation in an era of rapid change. First, legacy assets can be successfully repositioned when transformation strategies align with emerging market trends. Second, regulatory frameworks significantly influence adaptation capabilities. Third, private ownership structures introduce unique dynamics in managing a long-term program of innovation and change.

Successful infrastructure transformation requires careful attention by boards to multiple stakeholder interests, particularly in privatised assets with a significant role in regional economic development. The Port of Newcastle's experience demonstrates how industrial assets can navigate complex transitions while maintaining operational viability and building future growth potential.

This transformation model offers valuable lessons for other infrastructure assets facing similar challenges globally. Evidence indicates that success factors include clear strategic vision, stakeholder engagement and alignment with broader economic and environmental trends. The Port of Newcastle’s continuing journey from coal dependency to diversified maritime gateway demonstrates how industrial assets can adapt to changing market conditions while contributing to regional economic resilience.

*Professor Roy Green is the outgoing chair of the Port of Newcastle.

Comments